1. Term Life vs. Whole Life Insurance: Differences and How To Choose

May 10, 2023 · Term life insurance is temporary, covering you for a fixed period of time, while whole life usually lasts a lifetime.

Term life insurance is temporary, covering you for a fixed period of time, while whole life usually lasts a lifetime.

2. Term vs. Whole life insurance: What's the difference? - Forbes

Aug 9, 2023 · Term life insurance is a much cheaper option if you need coverage for a set number of years. Term life insurance may be a good fit if: You have ...

Life insurance policy types can be put into two main buckets: term life and cash value life insurance. One of the choices for cash value life insurance is whole life insurance. There are other cash value choices, too. Knowing the main differences between term vs. whole life insurance will help yo

3. Term vs. Whole Life Insurance: Which Is Right for Me? | 2023 - MarketWatch

Sep 20, 2023 · Since term coverage is generally more affordable, this option could be cheaper than increasing the face value of your whole life policy.

Explore the policy differences, price variations and investment opportunities of term and whole life insurance.

4. Term vs Whole Life Insurance | Bankrate

Sep 25, 2023 · Pricing: Whole life insurance is generally more expensive when compared to term life because the policy covers you for as long as you live and ...

Bankrate’s experts highlight the differences between term vs. whole life insurance.

5. Term vs. Permanent Life Insurance | New York Life

As a result, whole life coverage may start out more expensive than term, but in the long run it may prove to be a better value. Term life insurance costs:.

New York Life helps you learn the differences between term and permanent life insurance and compare their unique benefits to find the one right for you.

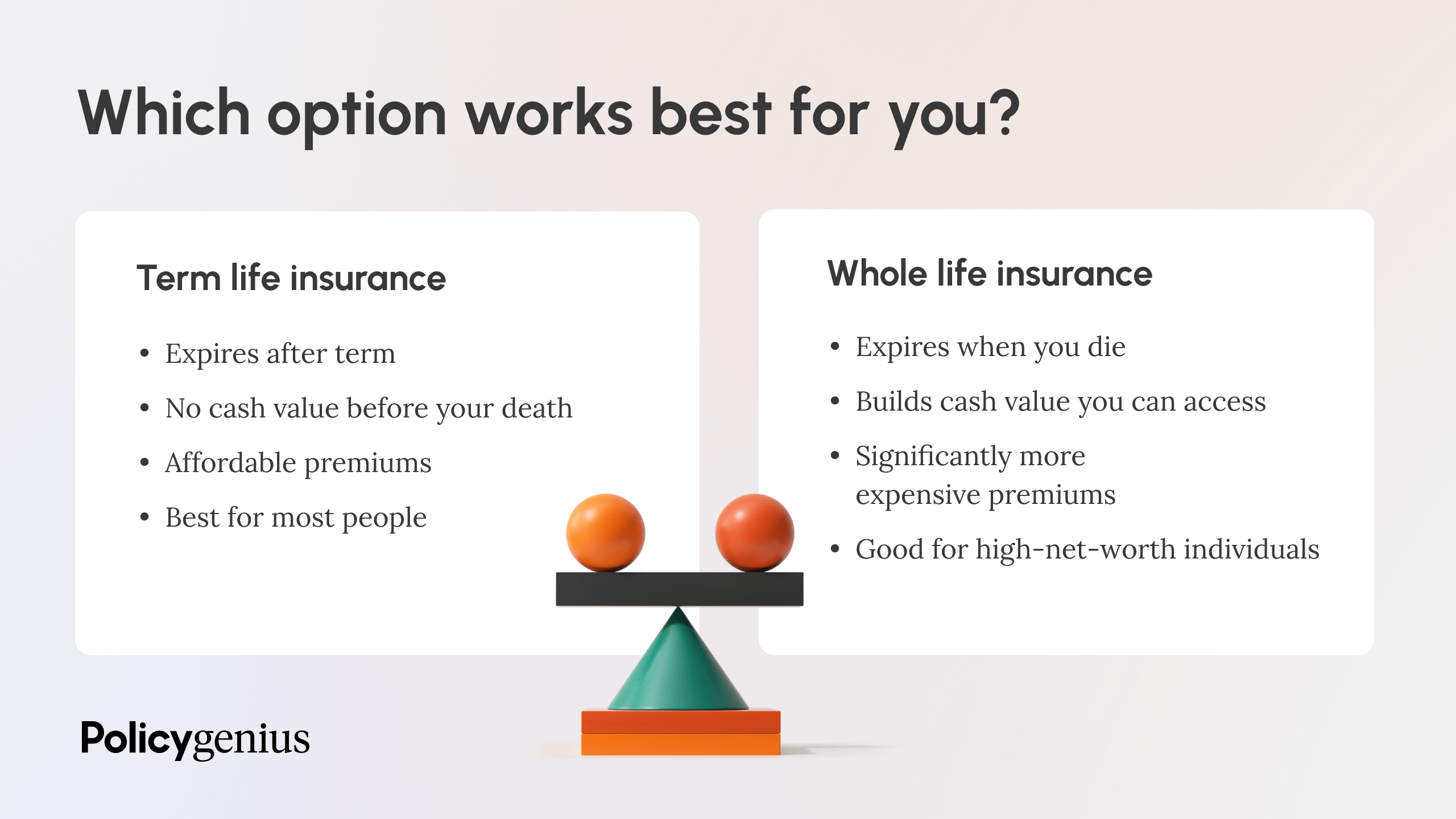

6. Term vs. Whole Life Insurance: What's The Difference? - Policygenius

Sep 7, 2023 · Whole life insurance is permanent, but costs a lot more than term life. Here's how to decide which type of policy is best for you.

Term life insurance is affordable, but expires at the end of its term. Whole life insurance is permanent, but costs a lot more than term life. Here’s how to decide which type of policy is best for you.

7. Term vs. Whole Life Insurance: What's the Difference? - Ramsey Solutions

Aug 25, 2023 · term life: Term life plans are much more affordable than whole life insurance. This is because the term life policy has no cash value unless you ...

Life insurance is not a fun topic, but if anyone relies on your paycheck, you need this coverage. The two main options? Term vs. whole life. But which is better? Let’s go over the differences now.

8. Term vs. Whole Life Insurance: What's the Difference? | Thrivent

Sep 20, 2023 · In exchange for this lifelong coverage and cash value, you can generally expect to pay more for whole life insurance than for term life ...

Both term and whole life insurance are designed for the primary purpose of providing a generally tax-free death benefit to your beneficiaries when you die. The most notable difference between term and whole life insurance is that term life is temporary, while whole life is a type of permanent life…

9. Term life vs. whole life insurance - Empower

Also, term insurance is usually less expensive than whole/universal life — often much less expensive. The biggest drawback is that if you don't die during the ...

Learn the difference between term life vs. whole life insurance in order to understand which life insurance policy may be right for you.

10. Term vs. Whole Life Insurance: Which to Choose? - Money Geek

If you're young, starting a family, own a home and have debts like car or student loans, the death benefit you need can be substantial. Buying term life versus ...

Should I buy term or whole life? Learn the differences between whole versus term life insurance, including a comparison of benefits and drawbacks.

11. Term Insurance - Life Happens

Why is it cheaper when initially purchased? Because with term insurance, you're generally just paying for the death benefit, the lump sum payment your ...

But what happens if you buy a term policy only to realize at the end of the term that you still have a need for life insurance? Well, it’s sort of a good news, bad news story. The good news is that many policies will give you the option to renew your policy when you reach the end of the term. The bad news is that you’ll probably face much higher costs since age is one of key factors used to determine life insurance premiums. To renew the policy, you also may have to present evidence of insurability (that’s insurance jargon meaning, “take another medical exam and answer a new round of questions about your lifestyle, health status and family health history”). If you’re still a fine specimen with healthy living habits, you might re-qualify at a reasonable rate. But if your health has deteriorated, you may find that it’s too expensive to renew your policy or you may not even re-qualify.

12. Term Life vs. Whole Life Insurance: What are the Differences? - Aflac

This choice is popular for young families because of the lower premiums upfront. It can also be a good choice for seniors factoring in their long-term plans.

Aflac provides supplemental insurance for individuals and groups to help pay benefits major medical doesn't cover.

13. Term Vs. Whole Life Insurance: Which is Better? (2023) - The Annuity Expert

If budgeting is paramount, term life insurance could be your go-to. However, your life may offer a more suitable solution if many depend on you. On the other ...

There are two main types of life insurance: Term vs. Whole Life Insurance, but which is better? Compare and contrast the coverage to find the best policy for you.

14. Term vs. Whole Life Insurance: Differences & How to Choose - Time

As we've discovered, term life insurance can be significantly cheaper than whole life insurance. ... life insurance, a term life policy may be the best choice.

Term life and whole life are types of life insurance policies. Each has benefits and drawbacks that you should understand when shopping for insurance.

15. Term Life Insurance Vs Whole Life Insurance - Which Is Best For You?

If your family will need money to also pay for estate tax, you might buy whole life. The bottom line is, whole life insurance is not an investment. The returns ...

Should you buy term term life insurance vs whole life insurance? Avoid making the mistake of buying the wrong coverage.Here's how.

16. Term vs. Whole Life Insurance: What to Choose in 2023

Some term life insurance is “annually renewable,” which means the premiums increase each year. The yearly premium increases can be considerable, especially as ...

Term life insurance and whole life insurance are two different coverage types, each with their own pros and cons. Read on to learn whether term life, whole life, or a combination makes the most sense for your financial situation, coverage needs, and goals.

17. Term vs Whole Life Insurance: Pros and Cons

While term insurance is great for temporary needs, whole life insurance policies are a long-term solution. Both types of coverage can work together. A term ...

Learn more about term vs whole life insurance. Our guide explains their definitions, policy types, pros and cons, which is better for you, and FAQs.

18. Term Life vs. Whole Life Insurance: Which Is Right For You? - CNBC

Aug 20, 2023 · Term life insurance can provide coverage during those years when your income is necessary for those who depend on you. Since it's generally more ...

While they're both types of life insurance, term and whole life insurance policies function quite differently.

19. Term life insurance is best option for most people, advisors say - CNBC

Jun 27, 2023 · Consumers can buy two types of life insurance: term or permanent. · Term life insurance is generally the best option for most people since it's ...

There are two broad categories of life insurance: term and permanent. Most people buy the latter, data shows, which doesn't jibe with advisors' suggestion.

20. Term vs whole life insurance | Money Under 30

Whole life insurance guarantees a payout no matter when the policyholder dies, and its premiums are therefore more expensive. Term is the best choice for most ...

Term life insurance guarantees a payout if the policyholder dies within a set term, typically 10-30 years. Whole life insurance guarantees a payout no matter when the policyholder dies, and its premiums are therefore more expensive. Term is the best choice for most people, while whole is the right fit…

21. Whole Life vs Term Insurance - Harry Levine Insurance

Apr 11, 2023 · If you purchase a whole life insurance policy that pays dividends, you have a choice as to how to use those dividends. You can either receive ...

Understanding life insurance can be confusing. Let's dive into the differences between whole life vs term life insurance to help you decide.

22. Term vs. Whole Life Insurance | Trusted Choice

Jun 20, 2023 · You might even get better benefits at a lower cost than you would with a whole life policy. If you get a renewable policy, you can extend ...

Wondering if there is a difference between term and whole life insurance? Learn more about each insurance type and which one is best for you.